I Took a Hike

Gear up for a hike like no other and discover the landscape of business, life, and the complex trails that intertwine them.

Embark on a journey with host Darren Mass and a new inspirational guest each week as they navigate steep terrain while engaging in thought-provoking conversations that unveil the intricate dance between entrepreneurship and the human spirit.

It's an exploration of wisdom, stories, and nature-filled inspiration. Lace up for an adventure where trails and tales intertwine, only on the I Took a Hike Podcast.

Interested in being a guest or sponsor?

Visit www.itookahike.com

Follow our journey here...

instagram.com/itookahikepodcast/

https://www.tiktok.com/@itookahike

https://www.linkedin.com/company/i-took-a-hike/

_____________________________________________________________________________________

I Took a Hike

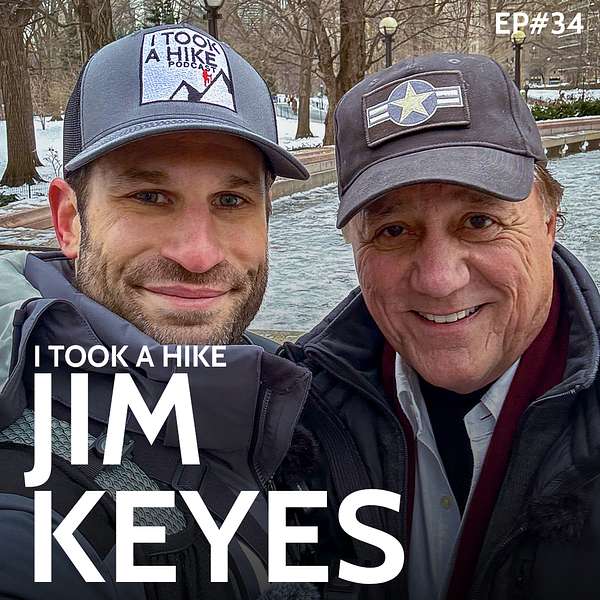

Jim Keyes - A Blockbuster Hike Through Central Park

Use Left/Right to seek, Home/End to jump to start or end. Hold shift to jump forward or backward.

Ready to take an invigorating hike during the freeze of a winter in Central Park - Alongside the last CEO of Blockbuster Jim Keyes?

Our topics include:

- The Freedom of Education

- The Climb from Impoverished Beginnings

- Leading Mega Brand 7-Eleven to Gas Station Sushi?

- The REAL Story Behind Blockbuster

In this episode, host Darren Mass joined by Jim Keyes, they reflect on humble beginnings to leading major brands, the real story behind Blockbuster's decline, and the importance of education as a pathway to freedom. Keyes shares his insights on overcoming adversity, embracing change, and the power of positivity.

The show also touches on the potential of AI, the value of experiences over material possessions, and the transformative impact of education on individual lives and society.

This episode is a deep dive into the nexus of business, personal growth, and the natural world. Sponsored by DeFi Supplements

00:00 Welcome to the Concrete Wilderness

01:00 Boost Your Health with DeFi Supplements

01:23 A Frosty Adventure Begins: Insights into Jim Keyes' Past

02:08 From Humble Beginnings to Corporate Success: The Story of Jim Keyes

03:37 The Transformative Power of Education and Purpose

04:32 The 7-Eleven Journey: From Gasoline to Global Convenience

13:35 Blockbuster's Untold Story: Debunking Myths and Exploring What Really Happened

26:59 The Downfall of Blockbuster: A Financial Collapse

27:50 The Business Model and Profit Strategies of Blockbuster

28:27 The Rise of Netflix and the End of Late Fees

29:18 Nostalgia for Blockbuster and the Last Store Standing

30:02 From Oppenheimer to AI: Humanity's Quest for Peace

31:40 Education as the Pathway to a Better Future

38:07 The Power of Technology in Education and Personal Growth

43:14 The Importance of Liberal Arts and Finding Joy in Helping Others

48:26 Concluding Thoughts: Change, Confidence, and Clarity

Contribute to the granola bar fund :)

Follow The Journey on Instagram

Tiktok?

Submit Feedback

Apply to be a guest

Become a Sponsor

Alright, jim Keyes, are you okay with being recorded on the podcast? Yes, sir, there goes that liability. This is I Took a Hike. I'm your host, darren Mass, founder of Business Therapy Group and Parktime Wilderness Philosopher. Here we step out of the boardrooms and home offices and into the great outdoors where the hustle of entrepreneurship meets the rustle of nature. In this episode, we take an invigorating hike during the freeze of a winter in Central Park alongside the last CEO of Blockbuster, jim Keyes. Our topics include the freedom of education for our future, the extraordinary climb from impoverished beginnings to the leader of mega-brands, and we set the record straight on the real story behind Blockbuster when we close that chapter once and for all, when I took a hike with Jim Keyes.

Speaker 1:This episode is sponsored by DeFi Supplements. Are you feeling stuck in a rut? Do you need more energy for the trail? Calibrate is a premium brain health supplement doctor formulated to help with energy, focus, mood and longevity. Visit defiyourmindcom and use code HIK for 20% off and you will defi your expectations. This is going to be an adventure in New York, always In the frozen, so we will end up doing most of this loop. We're going to learn all about you, so.

Speaker 2:I should be used to this. I grew up in a house literally with no heat. We had a wood burning stove, so there's absolutely zero excuse for me to be whining about sub-zero temperatures or 30 degree temperatures. We steps no bigger than me. I remember growing up back in the day, but it's one of those things when you grow up like that, it was actually an adventure. I loved it. It was like camping full time, and so I never knew that. I didn't know what the word poverty meant. Were you like that? Were you a pauperish growing up? Yeah, I didn't realize it Apparently. Apparently we were. We didn't have running water. We had to pump outside.

Speaker 1:Well, that's actually interesting If people who are not living in the confines of cities but outside in rural areas if they realize when they're growing up as children, if they are living in poverty or you just don't know any different.

Speaker 2:No, you don't know. In fact, I've got a great story. I was one time I was had the privilege of sitting on the board of the American Red Cross. I did a lot of work with them. We were on a mission one time and we're out in Vietnam, in this really rural area, remote area in Vietnam, and we were bringing mosquito netting, things like that, and we went into this village. All the little huts had dirt floors and I distinctly remember it was such a striking contrast because one of the women said how awful, look how these poor people are living. And I thought I was probably the only one that could really appreciate this. They were happy. They were like these were the happiest people I have ever seen. Now. They were happy because they probably had never seen Americans before, but they were truly filled with joy and they had no idea how poor they were, but it didn't matter.

Speaker 1:It's quite refreshing to realize that you can find happiness in everything, absolutely.

Speaker 2:Well, in fact it's. A big theme of my book is that we equate money and material things to freedom. But my book talks about really education being freedom, because the more you learn, the more you can do, and the more you do, the freer you are.

Speaker 1:That is absolutely true. It's the purpose and that's kind of the pursuit of this podcast and everything I've been doing after the exit of a company was I lost my purpose and my direction. And I'll say this in this sense man who loses their purpose or in a Confucius style sense, man who loses their purpose, has no value and you get really depressed and I'm with you on that. So I want to dive into your career a little bit, because you have a very interesting past.

Speaker 2:I've had some adventures.

Speaker 1:I know we're going to hear some good stories. I don't want to dive into the epic blockbuster just yet. Good A little of your background, though 7-Eleven.

Speaker 2:Yeah.

Speaker 1:You were the chairman and CEO of 7-Eleven, correct? I was president and CEO.

Speaker 2:Yeah, yeah, and it's a very, very interesting adventure, career journey, if you will, because I joined the company. I was there for like 21 years and joined the company on the planning side to be able to help them turn around an oil company that they had acquired called.

Speaker 1:Citgo Petroleum, so 7-Eleven had an oil company.

Speaker 2:Yeah, yeah.

Speaker 1:Okay, most people forget this. Okay, well, I didn't know this.

Speaker 2:Yeah, well, they acquired a company called Citgo Petroleum and it was the downstream operation of City Service, the major oil company. And so I had been previously right out of grad school working for Gulf and Chevron and had the opportunity to take over the planning function for Citgo when Southland acquired it. Okay, so it's kind of a conflict, so that would have brought you to Texas. Yeah, it was. Okay, it was. It's a much simpler story than I'm making it, but the Southland Corporation needed gasoline supply for their 7-Eleven stores, so they acquired this company, which was the refining and marketing element of City Service, called Citgo.

Speaker 1:Hence Citgo, yeah, yeah, yeah, the epiphany, it just hit.

Speaker 2:So Citgo, now part of 7-Eleven, a subsidiary of the Southland Corporation, and I had a chance to leave the major oil company and join them to do a turnaround on Citgo Petroleum, which we did. We were able to turn it from losing money to making money. That's a positive. That's a positive Return shareholder value. Exactly. We then sold that subsidiary to the government of Venezuela. So Citgo today is a Venezuelan owned oil company.

Speaker 1:So I remember hearing that when there was some strife with Venezuela a few years back and then there was a call to boycott Citgo because it was Venezuelan, so we sold Citgo to the government of Venezuela but kept a supply agreement for the stores, which was the original reason for buying the company. So 7-Eleven didn't always have petroleum and gasoline.

Speaker 2:Back in the day they had just stores, and then in the 70s and 80s gasoline became really a big convenience item.

Speaker 1:Hence the convenience aspect of the convenience store. Right, exactly, and it was a perfect addition to a store that already had everything that you wanted to buy conveniently anyway. Exactly, exactly, so what does the name 7-Eleven come?

Speaker 2:from. It came from the back in the, trying to think probably the 60s, I may not have that date right. They had gone from being open various hours to. They decided that from 7am to 11pm would be more convenient. Right, right.

Speaker 1:Okay, I got it. It's unlike CVS, who really doesn't know its name. I actually worked at CVS for quite a bit of time and it was in the manual. It said it was customer value service, customer value store. Whatever we are, it's just CVS now.

Speaker 2:I remember the first CVS in Massachusetts. I remember they had the name consumer value store.

Speaker 1:And then it was customer value store. They just kept playing with it. Probably somebody's initials, I'm sure. Yeah, probably Charlie, charlie, venezuelan. So how long were you at 7-Eleven? 21 years, so it was the full 21 years. Why did?

Speaker 2:you leave. We sold the company to our largest licensee, 7-eleven Japan, who had really perfected the model. They transformed the business when they took on the license, and if you've ever been to a 7-Eleven in Japan, oh, not in. Japan. Oh yeah, you got to do it. It's amazing.

Speaker 1:I got to go to Japan first.

Speaker 2:Yeah, it's a good start.

Speaker 1:I have a 10 year old daughter that wants to go to Japan.

Speaker 2:Take her. It's a great experience, great learning experience, and the stores are phenomenal. They have really used technology to improve their distribution systems and ordering systems, so they deliver to each store three times a day.

Speaker 1:That doesn't surprise me. The Japanese operations mind. When they're running businesses, they run it extremely efficiently. They practice kaizen little small incremental changes for monumental gains Exactly the most efficient company builders there is.

Speaker 2:Exactly. The best product they've ever sold is that you can get fresh sushi in a 7-Eleven store and I know the immediate reaction is convenient store sushi.

Speaker 1:I've shied away from convenient store sushi, except for hungover moments.

Speaker 2:You would not in Japan. You'd be amazed that it is restaurant quality probably superior to most Japanese restaurants here in the United States, which is hard to imagine, but it's true.

Speaker 1:Well, that'll be on the mark when I do end up going to Japan to eat some 7-Eleven sushi. Yeah, you gotta try it.

Speaker 2:It's literally world-class restaurant quality, great stuff. People in Japan use those stores three times a day. They go for breakfast, lunch and dinner. So it is very convenient, Very convenient.

Speaker 1:So they've got the operations down perfectly and do they own the licensees in the US as well.

Speaker 2:They bought the entire company. They were a licensee of 7-Eleven for years and 7-Eleven ran into some financial issues in around 1991. Did a leveraged buyout that didn't work so well and mine?

Speaker 1:You're a tootalitch.

Speaker 2:No, I was running the gasoline division. The gasoline division actually performed quite well, which really gave me the opportunity, coming out of a restructuring, to be the head of strategic planning for the new entity. That was a big career break because I had gone from planning to operations to running their retail gasoline business had a very good run. We exceeded all of our forecasts and we're making great money for the company. And then, coming out of the restructuring, they asked me to be head of strategic planning for the whole entity. Going forward From there, they gave me the privilege of being CFO, so I was able to then finance the plan that I was able to help build. And then from CFO they made me Chief Operating Officer. I was able to execute the plan. Wow yeah, it was a great opportunity.

Speaker 1:They promoted you throughout and which is interesting to me as someone who focuses on companies, putting the right people in the right seat. And the first time I got promoted to being a manager, my my manager had told me just because you're a great employee doesn't make you a great manager. You're gonna need to learn a whole new set of skills. So for you to go from the president of one division to, all of a sudden, the CFO, which requires a vast difference of skills to now operations Another set of skills the fact that you were able to commingle in between and see success is quite impressive.

Speaker 2:You've just described my book because, literally, education is freedom. I had to learn in each of those positions I had to deal with change Bankruptcy. Most people had their head down oh, oh, it's me, company's gonna go away. I worked harder, had my head up we'll get through this Deal with change. Have confidence.

Speaker 1:A bad rap. Bankruptcy is a reset. It is a tool that the government allows you for being part of the corporate program you are allowed. That's the plus and minuses of doing business is the fact that you're going to be a corporation and get government protections and you have to accept the bankruptcy rules. There's a restructure in chapter 7. Is restructuring not going out of business?

Speaker 2:Chapter 11, chapter 7.

Speaker 1:Yeah, chapter 7 is actually going out of business. 7 is going out of business. Chapter 11 we'll scrap that. Yeah, chapter 11 is restructuring and chapter 7 is going out of business. Chapter 11 is the bankruptcy that most people are aware of, and big companies, little companies alike, they all go through it and it offers protection. Stay protections from your vendors from just turning off the lights.

Speaker 2:Now. It's not a preferable thing. No one wants to go through it, but it does allow you to reset and companies can come out of it with a new life and the ability to go forward.

Speaker 1:Many do and, coming from the telecom industry and very familiar with bankruptcy protection and resets.

Speaker 2:Well, and that's what we did with blockbuster. We took it in to be able to deal with debt in the 2008 financial collapse and we're able to restructure the company. Come out with this network as our strategic partner, our owner of the business.

Speaker 1:Yeah, this network ended up buying blockbuster, correct? So you brought it up. So we're gonna obviously talk about the elephant in the room blockbuster. I have my own theories that I will share, but I want to see if they line up.

Speaker 2:So does everyone know 90% of them are wrong. But go ahead, let's hear yours.

Speaker 1:I'm not ready to go there yet because I think my theory does paint a better picture of what transpired. So you come in. What year do you come into blockbuster? Came in 2007. 2007, okay. So this is after the the challenges.

Speaker 2:We'll say they had already had some pretty severe challenges. And, by the way, to put this to bed, because there's an active rumor out there all over the internet that blockbuster turned down Netflix. That happened in the year 2020, 23 years ago.

Speaker 1:So let's jump ahead to that, because this is where my theory is. So in 2000, the CEO and the board of blockbuster was presented with an opportunity to buy the red envelope company. Okay, now.

Speaker 2:I don't know for sure how that transpired, but the discussion did happen.

Speaker 1:The discussion happened and we can make some guesses of what happened in that closed boardroom session or whatnot. They're not a threat. They are a threat. They'll go away, we'll squash them like a bug, whatever right, but they turned it down. Now many would view that that was the worst decision blockbuster could have made.

Speaker 2:Yeah, now, this is with the benefit of hindsight. Yeah, hindsight, if you were there if you were there in 2000 and you saw what Netflix had. They had a good idea. They had a great idea To do DVDs by mail. But blockbuster actually had a more robust infrastructure to be able to satisfy that same model. They had distribution centers. They could easily ship DVDs. They had stores that you could use to exchange them for the one you wanted. So blockbuster actually had an advantage in the year 2000.

Speaker 1:Strong advantage and being the bigger player Right. I imagine they kind of laughed it off like we don't need this unless we want to put the thread out of business, probably.

Speaker 2:I know I wasn't there, but I don't. I think they took it seriously, but I don't think they could see the, the value at the time, at the time, yeah, which probably most of us would not have.

Speaker 1:I. So this is where my theory goes and I think by our discussion we'll be able to put it to bed. So this is 2000, which is way before streaming and now coming from the telecom world. Yeah, we didn't have the internet connectivity, the infrastructure, the network components to allow quality streaming.

Speaker 2:Right, we were we're in Dawson environment right, with the green screen and a little blinker blinking cursor.

Speaker 1:So if, if I'm in blockbuster boardroom land and I'm being presented with this Netflix option, I see the opportunity for us, as blockbuster, to grow without them, but there's nothing else there, I'm turning it down. If blockbuster had acquired Netflix, it would have fizzled out, burned, disappear and Netflix would not be that was a good one actually.

Speaker 2:Yeah, yeah, thank you.

Speaker 1:Just go to the toilet with Netflix? No, but if blockbuster had acquired Netflix, it would not be what it is today. It's impossible because there's probably little chance that blockbuster would have pivoted to streaming services. Netflix had no choice but to pivot to create the brand they are Exactly, and that should hopefully put the argument to bed. Blockbuster would have done nothing with Netflix. It would have just fizzled, gone away.

Speaker 2:And there you have it. Well, I'll give you even another comparison Blockbuster to also put to bed the idea that Blockbuster management never saw streaming coming. Most people don't realize. Well, they could, because we all knew back in the day that the technology would be there. We just didn't know when. So Blockbuster actually had a deal that very few people know about With Enron.

Speaker 2:Oh yeah, yeah yeah, oh, okay, do tell, yeah, no. And this is fascinating. Think about it. Enron saw this coming. They had technology, Blockbuster had the brand and the business. Enron said let us build the streaming future for you and actually worked on it. They partnered up. Now take that example and the Netflix example and it was about the same vintage and say, well, what if Blockbuster partnered with Enron and went all in and bought them? Or if they bought Blockbuster, where would they be today?

Speaker 1:Well, we know the fate of Enron. Yeah, yeah exactly.

Speaker 2:So that but it would have caught up regardless. It shows you that it's so easy to look back and say, well, could or would it should have.

Speaker 1:Well, it also shows you that all roads for Blockbuster led to potentially nowhere.

Speaker 2:No, not true, Not true. Now that's where I have to differ. The reason I joined in 2007 is that I saw at 7-Eleven the power of technology. I had the advantage of our Japanese licensee transforming the convenience retail business with technology, and I saw that same opportunity for Blockbuster. Now it wasn't as easy as coming in saying we're gonna go streaming tomorrow morning Because, as you said, the infrastructure wasn't there, customers weren't there.

Speaker 1:Yet we didn't know what we didn't know.

Speaker 2:Correct Sort of a time stamp this. The iPhone was launched in 2007. Ipad not till 2009. So people had a hard time even envisioning watching movies on their little little ebiby screen.

Speaker 1:That's right, we were getting used to the fact that text was actually enjoyable and we could take a photo from our phone.

Speaker 2:Yeah, exactly, we were a blackbird using blackbirds back in the day.

Speaker 1:Oh, there's another case, doug, yeah, exactly.

Speaker 2:We talked to Blackbird about partnering on an iPad-like device. So Blockbuster had the opportunity. They had the brand. Here's the way I looked at the business Convenient access to media entertainment. They weren't renting DVDs. Yes, they were for a window of time. But what Blockbuster really provided the customer was convenient access to media entertainment. That demand wasn't going anywhere. Now, could they pivot and make that transition? Yes, so why didn't we? That's your question for me. Ha, ha ha.

Speaker 1:So why didn't? You, I didn't yeah exactly Good right on cue. I love that.

Speaker 2:Because what everyone also forgets is that in the year 2008,. The whole world collapsed, lehman Brothers melted down.

Speaker 1:Yes, with a CEO with a very appropriate name.

Speaker 2:Yeah.

Speaker 1:Dickfold. Ha ha ha, I love it. You can't make that name up, can't?

Speaker 2:make that up, I know.

Speaker 1:It's an amazing story.

Speaker 2:But now, going back to 2008,. By the third quarter, blockbuster had bought a streaming video company. Movie Link had rebranded it Blockbuster on demand. We had 3,000 titles. You can remember that, yes, Yep, new releases, something Netflix didn't have. We had the infrastructure there ready to go. We had something called Total Access stores, kiosks, online or by mail, and streaming. Everybody forgets that. So what happened? Well, we also had a billion dollars debt.

Speaker 1:Ah, and that debt saddlebag.

Speaker 2:Where'd the debt come from? Viacom spun the company out as a public company in 2004, and put a billion dollars of debt on it when they did perfectly reasonable. Blockbuster was a cash flow machine, so there was no reason to worry about that debt, but for the timing 2004,. Five year term, 2009. What no one knew is the financial markets in 2009 would be collapsed when it came time to refinance that debt.

Speaker 1:If you had known that, we would have had a very different outcome, but Very different the financial markets Right.

Speaker 2:Could I have done anything differently? Yes, when I joined the company in 2007,. My idea in joining and the reason I got to Blockbuster is I was trying to take it private Partner with PE, take it private. Do the transformation outside of the glare of the quarter by quarter public markets?

Speaker 1:Which, for those that aren't in the know, working at or for a public company, is just daunting.

Speaker 2:Very challenging.

Speaker 1:You are constantly rushing for every single quarter, feeling some mounting pressure to perform and if you don't perform well, your stock price.

Speaker 2:Right. And when you have a transformation like going from DVDs to digital, it's like driving down the street at 70 miles an hour and changing the tire while the car's going down the road.

Speaker 1:Perfect analogy. I love that.

Speaker 2:That's what it is. It's hard. We had the opportunity to go private but and if we did, we would have refinanced all the debt in 2007,. Never bad. In my last, at the financial market collapse, we didn't wish I had that decision to do over.

Speaker 1:Would that be a hindsight decision? Exactly yeah. So it didn't happen. So we're going to set the record straight here forever yeah, Blockbuster wasn't going to buy Netflix. Even if they bought Netflix, Netflix would not be who they are today. They would. You wouldn't know the name. You would have remembered them nostalgically as the red little envelope company.

Speaker 2:We probably would have screwed them up because we had big company.

Speaker 1:Big company doesn't pivot the small company. Integration issues, cultural mismatches, all the reason why acquisitions fail constantly. 70% of acquisitions fail because of cultural mismatches and there's no way that the giant would have gobbled up this little tiny company and pivoted success. Probably not.

Speaker 2:Probably May have but chances are.

Speaker 1:That's not the reason why Blockbuster went under. They went under because of the crisis and the inability to pivot fast enough, because of a saddlebag of debt Correct, just like many other companies.

Speaker 2:It happens, but there's a huge lesson there. The lesson is for all companies cash flow is your life flood. Cash is king. Cash is king. And could I have done a better job of managing cash flow? I tried. That's why we were focused on the stores, trying to improve the stores. So I was telling you at the timetable third quarter of 2008,. I know I have to refinance the debt we were really working on cash flow.

Speaker 1:We doubled EBITDA and tripled net Earnings before debt interest taxation amortization for anyone who doesn't know, it's a fun term that Sir get for cash flow. Basically, yeah, it really is meaningless in a private company, although we seem to like throwing the term around.

Speaker 2:Well, it's good in a private company because it measures your ability to satisfy your debt, but bottom line is we dramatically improve the performance of the company in 2008. Head streaming had all these other things you were poised for acceleration.

Speaker 1:Poised for acceleration, yeah.

Speaker 2:Moody is actually the rating agency. Standard reports of Moody's gave us a two notch upgrade in our debt rating. That's huge. That is huge. That is huge, yeah, and that all of this occurred in the third quarter release for 2008. But when Moody's gave us that upgrade, Lehman had just collapsed and they also gave us, unfortunately, an increase in our probability of default rating.

Speaker 1:And that sends the stock into Tizzy.

Speaker 2:Shockwish yeah.

Speaker 1:And that's the other problem of a public company is it's very easy to lose it all and be crushed. Because investors get sheepish, they get scared. Oh yeah, exactly, they freak out, and especially when there's a financial collapse, exactly, everyone's pulling out of the market.

Speaker 2:Fear, fear uncertainty, doubt, fun fact. A chapter in my book about fear. Yeah, because fear is a killer of so many companies. Because employees are afraid they quit, shut down, vendors are afraid they collapse credit terms. That's really, if you want to get right down to the weeds, what happened to Blockbuster. The studios went from 90 days so we could buy a DVD for $15. And then, over the next 90 days, rent it 20 times more than pay for it. Talk about a cash flow machine, right?

Speaker 1:Huge market.

Speaker 2:Yeah, but when the first studio said, because Moody's now declared you a risk of default, we don't want to be caught with an outstanding receivable, so we're going to take you to cash terms, and then it was like a house of cards the other studio's default.

Speaker 1:Cash flow again.

Speaker 2:you didn't have enough cash to keep it up $300 million of cash out of the business in a week yeah, just like that.

Speaker 1:So is that how Blockbuster worked? Is that they would almost have a consignment with the studio, More or less?

Speaker 2:yeah, because of the terms, credit terms, and it wasn't really a consignment deal. But the credit terms were so favorable that there was never a reason for Blockbuster to file bankruptcy, but for the debt. And then, when the credit terms evaporated, the business model collapsed.

Speaker 1:And the business model really. I mean, you had a quick ROI If you bought the DVD for $15, what was a rental? I don't recall, was it $3.99? $3. $3 to $5.? All right, so rent it, let's say, between five and seven times and you have a complete ROI. Yeah, everything on your shelf is pure profit.

Speaker 2:Yeah, it was a beautiful business. It was a beautiful business and that's before late fees, which the company eliminated before I got there.

Speaker 1:Well, I bet the company loved late fees. That late fee is just pure bottom line profit.

Speaker 2:Yeah, it was $80 million of EBITDA cash flow.

Speaker 1:Yeah, that one, it was late fees.

Speaker 2:Yeah, just late fees. So the customers were annoyed by it, understandably. But the irony is Reed Hastings said he started Netflix because he was annoyed over late fees. But realistically, blockbuster could have just said well, do DVDs by mail, no late fees, just like Netflix.

Speaker 1:Well, that's where a great idea comes right. You take someone else's issue and you can make it into an advantage for yourself.

Speaker 2:But that was one of those management decisions that I think hurt the company pretty badly, because they didn't get what they thought was sales are going to respond immediately. People would be thrilled in, no late fees, so they'll all come back to the store.

Speaker 1:I remember the ads, the marketing around the just rented and just return it whenever. What do you mean? Whatever Turn it whenever, no late fees. I think we all, in a nostalgic way, miss going with our family to go pick out a VHS. Smell of that popcorn and the candy. We miss that. I would love to see that again. And do you know? I don't know if you've paid attention since, but do you know when the last Blockbuster store had closed?

Speaker 2:down. Well, it's still open. Bend Oregon.

Speaker 1:Yeah.

Speaker 2:Yeah, they're still open.

Speaker 1:Oh well, on Wikipedia they have her closed down in 19. I think she's.

Speaker 2:I'm pretty sure she's still there. But it's a story of persistence because she was not willing to accept they were going to close the store.

Speaker 1:Netflix has a special on it. They have a documentary yeah it's hysterical. Which is amazing.

Speaker 2:So here's the question though, do you see, oppenheimer?

Speaker 1:Yes, oppenheimer frustrated me.

Speaker 2:Yeah, frustrated me too. But the thing I didn't know about Oppenheimer is I didn't realize how much they believed that this technology would bring peace to the world, because it was so devastating, yes, that humans would not want mutual mass destruction, right. Well, it didn't work out and ended up being an arms race. We all know what happened. So the question is will AI present humanity with that same opportunity to bring peace to the world.

Speaker 1:I think we can come up with an answer here.

Speaker 2:Well, it's interesting because every military friend I have says it's impossible. It's going to go to the strongest military to use it to weaponize it. Here's my question the first time it gets out of control and the first time machine learning actually dominates human beings, will that be our wake-up call for humanity? No, well, I hope you're wrong.

Speaker 1:I hope I'm wrong too, but it's again. We can play hindsight, armchair quarterback and all that. We have too many examples where human beings don't put up the stop sign until the accident happens, and then sometimes it's too late.

Speaker 2:Well, that's what I'm hoping. If there's an accident, does that bring the world together to say, hey, all right, guys, we have to work together.

Speaker 1:I do see that it is going to be too big of a crutch for too many people and eventually the machine, the AI, will write code for itself, and that's where the bad stuff happens. That's the Skynet.

Speaker 2:So here's literally why I wrote the book, because what is the name of the book? Thank you.

Speaker 1:Education is freedom. Education is freedom. I will subscribe to that one for sure.

Speaker 2:Yeah, and it's a call to action for individuals to take learning in their own hands, because there's no excuse today, with the power of just existing technology, you're struggling with algebra, khan Academy's free you put in the time, you can learn anything you want online. That's the call to action to the kids, but the call to action to humanity, literally, is that the answer to all of this stuff is ultimately educating the world. And this sounds cliche, but if you could replace bombs with books, then you replace terrorists with teachers. I mean, I know that's ridiculously simple. Yeah, it's very lofty and very polyanis, but it's true in essence that if we dial up the knowledge of humanity, think about what we're doing today. Conventional warfare is an acronym. I mean, we're out there with tanks blowing each other up.

Speaker 1:It's like there's no lines anymore.

Speaker 2:There's no lines. So is it possible to elevate the overall knowledge of humanity to the point that we can get beyond this archaic way of behaving and find other solutions? Now, I know that's crazy.

Speaker 1:I think it's a little grandiose just knowing that we do have fundamentalist thinking in other cultures, and I think you're coming at it from an American lens, where this is the land of opportunity. You could do anything, and anyone who laughs at that and says bullshit, no, you could do anything you want to do if your drive is in the right direction.

Speaker 2:Yes, exactly, but even worldwide, much of the fundamentalism that we deal with in the world stems from the ability to control those who have no future, they have no education, they have no economic status. So, and this is my question, can technology quickly enough bring knowledge to the globe? I mean worldwide? There are more cell phones in the continent of Africa than in the United States, it's greater penetration, and that cell phone is a portal to knowledge, to information. So can we light up those portals and help people learn in a way that's never been experienced by humanity?

Speaker 1:So what would the learn it? So let's say you're in a fundamental extremist culture, and how could lighting up affect change?

Speaker 2:Simple answer and again, this is too grandiose and too naive that I believe this. But thanks for the preface. I have to say that. But critical thinking goes all the way back to the earliest days of man and the Greek philosophers and Plato, asking why and challenging conventional wisdom, whether it's conventional religion or just conventional science or conventional politics. That critical thinking element is something that we're not practicing worldwide as much, Even here in the United States. You see it happening Well we come to our position.

Speaker 1:We get lazy Again, with the average 100, right, this is not equating 100 to lazy, but because there are so many people that just immediately doubt that they could be a leader and entrepreneur, business owner, successful person, they get lazy and fall prey to that.

Speaker 2:That becomes the doubt Right exactly.

Speaker 1:You know, I tell my kids all the time when you say can't, you absolutely won't. Exactly, you have the ability to do anything. Yes, there are lucky scenarios that we can put ourselves in, take ourselves in and out of luck, you get lucky to an extent. You are lucky if you're born into a specific family or demographic or country or culture. Yes, that is your one stroke of luck that can set you up with an easier or better hand. But what you choose to do with that is up to you. There are plenty of super wealthy families that have super wealthy babies from the start and those super wealthy babies turn out to be pieces of garbage and live horrible lives. You could say they were lucky, born in the family, or that is what destroyed them. You can say and we've had many examples of people that grew up in the worst situations possible absentee mother, no father, call it whatever you want and they have risen to success. So you create your own fortune and if you allow yourself to say I can't because, then you absolutely won't.

Speaker 2:Exactly. So, chairman of the America Red Cross, bonnie McElven Hunter. This amazing woman created pace communications. She's been the longest running chairman of the Red Cross ever.

Speaker 1:Oh, wow.

Speaker 2:Yes, she tells a story. Her mom took her, she and her daughter and her sister out in the backyard and made them right can't on a piece of paper and they buried it in a box.

Speaker 1:I might try that with my kids. Yes, it's a great. It's a cool story. I love stuff like that. Yes, I got it in the book. Yeah, well, I'm absolutely going to read the book and I will say this too you are not sponsoring this show. No, I do not allow guests to sponsor their show or their episode. It's disingenuous to me.

Speaker 2:Well, and I'm not making money on this book.

Speaker 1:My objective is I'm not making money on this podcast Look at that. We're in the same boat.

Speaker 2:No, my objective is to get the word out, because I really do believe that humanity is at the crossroads here. But I'm more optimistic about the future of humanity because I do believe and I've seen the power of technology to light people up. I'm going to give you a great story, front of mind Will Talley. I put him in the book and Will was one of those kids.

Speaker 1:By the way, great name.

Speaker 2:Will Talley William.

Speaker 1:Talley, it sounds like he's very stately.

Speaker 2:He is Midwest Farm Boy by 6'5" Good, good kid. He grew up wholesome American values, but he hated school. He was like B minus C plus maybe. In grammar school he was struggling. His mom was worried about him. He kept talking to him Well, what do you like? He was constantly playing video games, mostly war games. He was looking at YouTube videos. I was like, hey, will, don't you think you could use those YouTube videos If you like, looking at World War II stuff, to supplement your education? History is all about looking back Once you use YouTube videos. And he started doing that and he got so excited that he didn't have to learn history out of a book. It lit him up. He went through high school and ended up with a 4-0 average. I'm so proud of him. I wrote a recommendation for him to get into Harvard. He's now a sophomore at Harvard. He's going into his sophomore year.

Speaker 1:That's the alternative learning, almost like a Montessori style learning. Everyone's motivated by something else and you can learn from almost anything if you're again willing to do it.

Speaker 2:That's the power of technology we can light up the world and ignite their curiosity and their critical thinking, all of those things that have laid dormant for so many years. We're clearly a pessimist. Oh yeah, you can tell.

Speaker 1:You think there's such thing as humans being too successful?

Speaker 2:Too successful.

Speaker 1:I'll preface it Every great civilization has crumbled and burned, from the magical, mystical Atlantis to the Roman Empire, the Byzantines, the Ottomans, the Greeks. They all collapse, many of those being democratic societies. Is there such thing where the people have too much control, too much say, and we collapse?

Speaker 2:I hope not, but I do think. Again, it depends on the evolution of those people. I think what happens is they fall prey to leadership using those lowest common denominators, instilling fear, and then they start to cannibalize from within. It happens, it's embarrassing, it infects from within. You'd think we'd learn from other civilizations that have done exactly the same thing.

Speaker 1:That tells back to the AI conversation of why I think you can recognize patterns. I don't know how much faith I have in humanity to get this go around right, I think. Unfortunately, sometimes you need to have the freight train accident before you start looking at safety.

Speaker 2:It's very likely that that will have to have that catastrophic event. Whatever it is, you know what the best thing to happen to humanity could be An alien race visiting the earth.

Speaker 1:Whoa pump the brakes, kids. Let me show you how it's done. You know what?

Speaker 2:I don't care what race you are, I don't care what your religion. We're all humans. Come on, let's hang together.

Speaker 1:There's no extreme example here because we are in New York City 9-11, which is horrible and horrific, especially as a New Yorker, but everybody came together. Everyone was flying a flag and proud. Now we are so torn apart and disjointed. But it doesn't have to be and that's the thing, we just all need to figure it out.

Speaker 2:We all need to figure it out. And if we can get back to those fundamental skills, fundamental things we all learn in grammar school, we all need to figure out how to get back to the right place. How many conversations do people actually sit down and go tell me why you feel that way?

Speaker 1:Let's talk, yeah, but unfortunately we live in a black and white world. If you don't like my football team, I don't like your face. Where you live, football is life.

Speaker 2:But ironically that's not a democracy, because a democracy is all about people coming together and compromising. So maybe we need education on being democratic again, what we kind of do and that's kind of the point I'm trying to make that we all grew up flag waving, proud Americans, believing in the democracy and democratic system, and yet we're not behaving that way. We're behaving like my way of the high-law. I'm right, you're wrong.

Speaker 1:And the worst people of all, adults. Adults, they act worse than children, oh, the kids.

Speaker 2:that's why I've got a lot of hope in the next generation, because they're looking at us going. You guys are crazy, they're the aliens?

Speaker 1:Yeah, Sure, sure you guys are nuts. So let's get back to the business world. What do you think the most valuable lessons in education are for a budding entrepreneur?

Speaker 2:I'm a big believer in the liberal arts approach because at that age I don't think most of us know what we want to be and the liberal arts gives you exposure to a more classical education rather than specializing very early. I know some kids want to be engineers. Like you, in high school Most of us don't really know what they want to do. I wanted to be a first. I wanted to be a doctor. I was a terrible doctor. And then I wanted to be a lawyer. I was a terrible lawyer. I actually had an intervention. I had a professor undergrad. He was a history professor, had me in class for two years. Where are you going to school, jim? I told him I got into these two law schools and he's like no, you can't, you'll be a terrible lawyer. I've seen you in class but he said you got to go. Promise me you'll get an MBA, even if you do a JD MBA.

Speaker 1:So was that the person that changed your life? Yeah, what was his name?

Speaker 2:Father Lapamata. He was a priest, yeah, a Jesuit priest, lapamata, yeah. And I mean here's a guy that thank goodness he intervened and I was a Holy Cross undergraduate and he jumped in and said here's what you need to do. So what brings you the most joy? I think the most joy is being able to share this idea that anybody can do anything. I've had some amazing opportunities, but the best thing that can happen I had a kid walk up to me one time in a restaurant I was checking out the sushi bar it has branded Nata the 7-Eleven.

Speaker 2:No, not Nata the 7-Eleven. I wasn't in Japan Full circle. We don't sell sushi here in the United States. But he said you, mr Keys, I guess, did you start the Education and Freedom Foundation? I was like, yeah, you guys, man, thank you. He shook my hand. It's like I'm the first kid in my family to ever go to school. He was at Southern Methodist University at the time. He was going to go off to med school or something. He was just grateful that we had given him a jumpstart, made him believe in himself. And that kind of thing happens to you and it's like the best. It's the best because you realize you're making a difference. Even if it's one life, you're making a difference. That checks the altruism bucket.

Speaker 1:That is phenomenal. I love hearing stories like that. It's because you decided to invest in a positive path and this positive path yielded a great life for you and paid dividends for other people.

Speaker 2:Yeah, well, that's the hope. That's the hope and I get caught up a lot. The lifestyle makes it look like it's all about the money Because, yeah, I fly my own airplane. It's a privilege. I'm grateful every day for that privilege of being able to do that. I drive a nice car, but really the motivator for me is the ability to experience life, to do things. That's what freedom is all about. It's not having more money than the other guy. I know a lot of very rich and happy people.

Speaker 1:You and I are very, very similar. After an exit, I had the money Great, but I was very depressed. Money buys you a whole bunch of don'ts Things you don't have to do or worry about. It gives you the ability to have options, but it does not fix emotional, mental issues. It's cool to have nice things, but it doesn't bring purpose. In fact, I know plenty of very wealthy people that are miserable.

Speaker 2:Do you have a George Carlin's thing on stuff? He does a whole thing about stuff. That's why we have homes. Oh, yes, because we have to have a place for our stuff. And then you get more stuff, and then you need a bigger house for more stuff.

Speaker 1:He has a documentary on HBO. Obviously he's no longer with us, so they have one. If you were to replace some of his narratives with today's people, it's all repetitive and it shows you. Over the 60 years of his career, the message never changed and, full circle, human beings never changed either. It's very apropos today, and if he was alive today and still doing his comedy, it would be relevant. Year after year after year, decade after decade, he never faded away. So we are nearing the end of our trail. This is fun.

Speaker 2:See, that is why I do this. Yeah, I confess I was a little skeptical. I was like we're going to do what? We're going to go out and take a hike.

Speaker 1:Well, typically we've done these in warmer conditions, but you were down for the winter and I wanted to see how it would go. Little sniffly and runny nose. No one slipped and tripped too bad, not over yet the sniffs are going to be pretty pronounced. That's fine. We'll soften them with filtering, but you see them. Get me on camera. I think I got a couple of those in there. Don't worry, you don't want to shake these gloves. So do you have any parting words of wisdom?

Speaker 2:Most important advice that I have and I get this question a lot what would you tell your 17, 18 year old self? And first thing I'd say is calm down, it's going to be OK, because we all worry too much right, yeah.

Speaker 2:And we are all victims of that fear. You know that, oh my gosh, I'm going to fail Imposter syndrome, all that stuff. So that's the first thing I'd say. But I have three things, and actually the origin of these three things are kind of cool. Happened in a dream. Shortly after becoming CEO, I had this crazy dream Super realistic, like a near death experience where you have the bright light. In the dream. I was sent on these three tasks and I performed the tasks. I didn't know if I was going to be successful or not, but I did each of the things I was told and I was promised a gift at the end. And then I woke up and I was like damn, where's my gift? Come on, that's not fair. You know those dreams. You want to go back to sleep.

Speaker 1:I don't want to finish this. You can't put yourself back in there.

Speaker 2:No, no I want to get the gift. And I started telling people about this dream and, in particular, I woke up my wife. I was like hey, I had this dream, I got to tell you about it.

Speaker 1:And then she rolled over and said uh-huh, Crazy dream. Yeah, I don't want to hear about that. Careful about what you want to tell me.

Speaker 2:But I wrote down three words Change, confidence and clarity. I shared those the next morning and she said has did my friends, that's why you are where you are. That is your gift dummy.

Speaker 1:Change, confidence and clarity.

Speaker 2:You've been able to your whole life, overcome insurmountable things that are what other people would say make you hopeless, whether it's divorce or parents or poverty, or having a house condemned when you're a little kid and you come home and see the red sign. You've overcome all that stuff, but you've come out on the other side with a very positive attitude and you're able to weather that storm and it's maybe stronger so you can deal with change as crazy as taking over a blockbuster and then having the financial markets melt down. You take it in stride, you deal with it and then you have the confidence somehow to believe you can accomplish anything, whatever you want to do. And that confidence is backed up with preparation, because you work your butt off. You're able to be confident because you know that you'll tackle whatever it is that you have to do. And the third is clarity and the ability to take really complex things and make them simple. And so I have to do that, because I'm not that smart, so I have to take complex problems and make them simple.

Speaker 1:Well, I highly doubt you are not that smart, but I think change, confidence and clarity will be the title of your episode. I might throw in blockbuster change, confidence and clarity. There you go.

Speaker 2:There you go, but it applies. I could have bailed. Very apropos, yeah, I could have bailed on blockbuster. It wasn't my problem, I didn't start it. I was there for a year and a half when it started to melt down. I could have bailed.

Speaker 1:Yeah, but your personality wouldn't allow that. You can't admit failure.

Speaker 2:No Well, you never fail. I use a Mandela quote I never lose, I win or I learn. That guy was in jail for 20 years. He didn't lose, he studied law while he was there. He could have died in prison just from depression, but no, he studied, learned the law, came out as president, and it's so applicable to everybody. It's really the reason behind the book, because the power of knowledge to turn the worst situation into an opportunity is something that too few people really embrace.

Speaker 1:Well, Jim Keys, this was a blockbuster of a hike. I absolutely enjoyed being alongside you here in your story. You are a very positive human and I love to surround myself with positivity. You are clearly very successful. We have set the record straight on the Netflix dilemma and you are inspiring the world. Get his book. Education is Freedom. It's phenomenal. I know I will be getting it and I will buy it too. I actually have a copy for you. I guess I'm not buying it, but otherwise.

Speaker 2:I would buy it. I'll buy one too. I need the sale.

Speaker 1:There you go. This was a very inspirational journey. I'm happy you said yes. In fact, you were also demonstrating a core value of mine, and that is to say yes to every opportunity that aligns with your purpose. It is the reason why I'm here today. It is the reason why you are here today. You say yes to opportunities without even thinking about any other answer.

Speaker 2:Burry a can in the box in the backyard.

Speaker 1:You have to do that with your kids. I will bury my cants with my kids. I absolutely love that. So, jim Keys, thank you for hiking with us.

Speaker 2:Thank you, this was fun.

Speaker 1:Yes, my hands are frozen. I didn't even have gloves Next time on, I Took a Hike. We take one of the most inspirational life purpose journeys with Scott McGregor, ceo of Something New, author of the Standing O Series and the founder of the Outlier Project.